Previously, PayPal had a flat rate for merchants and sellers of 2.9 percent of a transaction’s price, plus a 30-cent fee. Now, that rate is seeing an increase depending on the method of payment.

PayPal Raises Merchant Fees for Some of Its Newer Functions

Senior vice president Dan Leberman has posted to PayPal Newsroom saying that the online payments system is raising its published rates in the US.

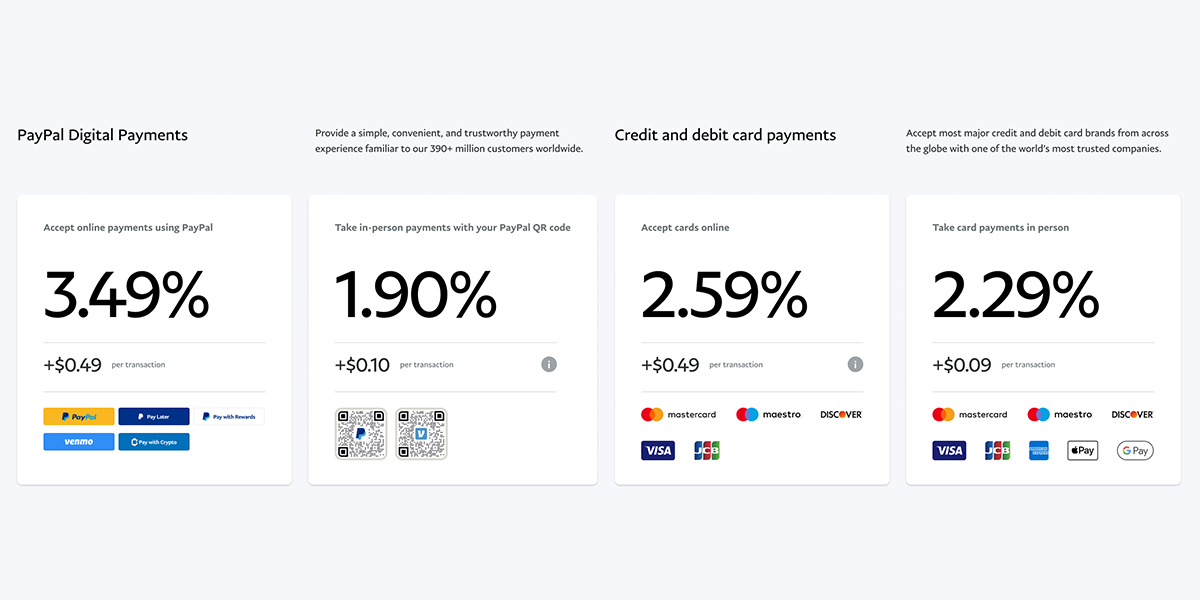

The new rates will apply to some merchant users starting August 2, as the feature will presumably take a little while to fully roll out. Here’s a breakdown of all the costs for each payment method per transaction:

- Digital payments (e.g. PayPal Checkout, Pay with Venmo, etc.) – 3.49% + $ 0.49, including Seller Protection on eligible transactions

- In-person payments – 1.90% + $ 0.10 (or 2.40% + $ 0.05 if your sending $ 10 or less) for QR code transactions, and 2.29% + $ 0.09 for certain debit and credit transactions

- Online credit and debit payments – 2.59% + $ 0.49 without Chargeback Protection, or @.99% + $ 0.49 with Chargeback Protection

- Charity transactions – 1.99% + 0.49 for confirmed charities, subject to application and pre-approval

If you’re a US merchant that has custom or non-standard pricing, PayPal says that rates remain unchanged for your services.

Why Is PayPal Raising Its Fees?

While the blog post does have a header that asks, “Why are we making this change?“, the text beneath it seems to beat around the bush instead of explain the company’s reasoning—Leberman first talks about the “benefits” that merchants receive in using PayPal.

For instance, customers that use PayPal are purportedly 60 percent more likely to convert their payments to your preferred currency than those who choose an alternative payment method.

But all that aside, it would seem that PayPal is trying to say it needs more funds to improve the service:

Additionally, we are continuing to partner and invest in our platforms to enhance payment experiences, provide greater choice for the way people pay for goods and services, improve protection and security measures to give people peace of mind when transacting digitally, and improve authorization and conversion rates.

It’s worth nothing, however, that the digital payments sector is seeing more competition these days. PayPal may own Venmo (a payment app focused on more personal transactions), but there’s plenty of other popular digital options to send money.

Cash App, Stripe, and even Twitter’s newly-added, on-profile Tip Jar are seeing a good amount of traction, so perhaps this is PayPal’s attempt to make up for losses as some folks swap to other alternatives.

If you want to learn about PayPal’s new changes in-depth, you can view the notice on the Policy Updates page, the Merchant Fees page, and/or the Pricing FAQ.