Reddit and Robinhood users have been caught in a firestorm over GameStop stock after shares in the downtrodden company rocketed from $ 20 to $ 400 in just two weeks.

The story is now front-page news around the world. But how did we get here, and what happens next?

(Disclaimer: We are not financial advisers. You should not use any of the information contained in the post to make investment decisions.)

The Rise of r/WallStreetBets

At the core of the story is the rapid growth of r/WallStreetBets, a Reddit community famed for its series of high-stakes trades in the market.

Three years ago, the WallStreetBets community had 180,000 members. Today that number stands at two million.

The rise in r/WallStreetBets membership has been largely driven by the smartphone app, Robinhood. The app changed the investing industry with the launch of commission-free trading.

Crucially, Robinhood also made it free to trade options for the first time. r/WallStreetBets users prefer to trade on the options market rather than buying and selling regular shares because the strategy exponentially amplifies gains and losses. Robinhood became the perfect companion.

Equally importantly, by removing the cost barriers, Robinhood allowed more young people than ever to learn about the market and start day-trading. Young people are also Reddit’s largest demographic and the most risk-tolerant from an investment perspective.

Robinhood users gravitated to r/WallStreetBets, and r/WallStreetBets users gravitated to Robinhood. The beginnings of a perfect storm were put in place.

WallStreetBets and Meme Stocks

The public’s perception of WallStreetBets is that it is a casino, a place where people throw money at meme stocks with little idea of what they’re doing, then joke about their huge gains and losses.

This is a false narrative.

While the type of language used in posts and the size of some of the gains might give that perception, many people on the subreddit are true experts with an intricate understanding of how the markets operate.

The trades they take are high-risk but are not taken blindly. They use the subreddit to post complex justifications of their positions, much of which is far beyond the expertise level of a regular Robinhood user.

GameStop

GameStop has endured a difficult few years. The rise of platforms like Steam paired with major consoles’ decision to ditch disk drives has seen the company’s revenues plummet.

The decrease in sales had been reflected in its stock price. In 2014, it was trading at $ 50/share. By late-2019, it was down to $ 3.50.

But one WallStreetBets user noticed an opportunity. The company still had excellent cash reserves, a lot of retail locations, and had replaced its leadership with a more visionary board of directors. He believed it was grossly undervalued.

He wrote a lengthy post detailing the position he was about to take and invested $ 50,000 into GameStop options.

Initially laughed at by fellow WallStreetBets users, the person continued to add to his position over the coming months.

COVID and 2020

The COVID crisis fuelled interest in Robinhood and WallStreetBets yet further.

In March 2020, as COVID first spread around the world, the global markets experience a historic crash. More than one-third of their value was wiped away. With people stuck at home, spending less, and collecting government relief checks, many found extra space in their budgets to try and trade for the first time.

Suddenly, WallStreetBets had found a critical mass. Now it needed a project.

Interest in GameStop started to grow. When the company announced in June 2020 that it had seen 519 percent growth in online sales due to the crisis, the stock began to gain real traction among WallStreetBets users.

In August, the popular Chewy co-founder, Ryan Cohen, bought a nine percent stake in the company and announced a plan to turn it into an Amazon rival. In September, he increased his stake to 13 percent.

It was at this point that WallStreetBets users came across a startling discovery. It was detailed in a post by u/Player896 titled “Bankrupting Institutional Investors for Dummies, ft GameStop.”

Hedge Funds and Short Stock

GameStop’s years-long decline had led to it being one of the most shorted stocks amongst institutional investors.

A person who shorts a stock expects the price of the stock to go down. To make a profit on the move down, they borrow a stock from a broker, sell it immediately, and then plan to repurchase the stock at a cheaper price in the future. They can repay the broker the stock they borrowed and keep the difference.

Shorting in the markets is commonplace. But WallStreetBets realized that GameStop was different.

Hedge funds had borrowed more GameStop stocks from brokers than there were in existence. This is highly unusual. We don’t want to get into the technical aspects of how it’s possible, but suffice to say that a broker can lend the same share to multiple traders over and over by simply buying it back each time.

In total, more than 130 percent of GameStop’s total shares were owed to brokers by hedge funds. It was already at 90 percent—dangerously high—back in late 2019. Now we were looking at a stock market record and a tinderbox situation.

WallStreetBets users realized that if they could buy up all the GameStop stocks in existence and never sell, they would have Wall Street and hedge funds over a barrel. The funds would owe billions of dollars of stock to brokers, but there wouldn’t be any supply on the markets. The price would explode, and a potentially infinite money tree could be born.

Check out this story on Bloomberg for a deeper look at the financial side of it.

January 2021

In mid-January, things started to come to a head. The price was creeping up, and it was apparent that the Reddit users were onto something significant. Wall Street was rattled.

It was then that the popular investment-orientated Twitter account, Citron Research, posted an ill-timed tweet:

Tomorrow am at 11:30 EST Citron will livestream the 5 reasons GameStop $ GME buyers at these levels are the suckers at this poker game. Stock back to $ 20 fast. We understand short interest better than you and will explain. Thank you to viewers for pos feedback on last live tweet

— Citron Research (@CitronResearch) January 19, 2021

It quickly became apparent that Citron itself was short in the GameStop stock. The group was posting the tweet in a bid to scare away new buyers and protect its position.

Redditors and Fintwit (financial Twitter) users saw straight through the plan. The price doubled within a day, the short percentage grew to 140 percent, and the game was on.

What’s Happened This Week?

The Reddit community was proved right in spectacular fashion. The price went from $ 70 to more than $ 300 in just three days. WallStreetBets was winning.

And then the controversy hit.

There were signs on Wednesday (January 27) that something serious might be happening. CNBC gave the story highly negative wall-to-wall coverage, while rumors circulated about hedge fund bailouts, multi-billion-dollar liquidations, broker bankruptcies, and possible SEC involvement.

Here’s the official SEC statement, released at lunchtime:

We are aware of and actively monitoring the on-going market volatility in the options and equities markets and, consistent with our mission to protect investors and maintain fair, orderly, and efficient markets, we are working with our fellow regulators to assess the situation and review the activities of regulated entities, financial intermediaries, and other market participants.

Discord took down the WallStreetBets server, and the Reddit community was forced to go private for a few hours to prevent it from being overwhelmed with anti-GameStop bots.

Reddit users started to feel like the machinations of Wall Street and the financial media were conspiring against them.

A Dark Day for Robinhood and Free Markets

Thursday (January 28) saw the real drama begin.

In mid-morning, with the price swinging by as much as $ 200 in an hour, Robinhood prevented its users from buying any further stock in GameStop. And Robinhood wasn’t the only one, as Webull, ETrade, and Interactive Brokers all followed suit. Only sales were allowed, and the price plummeted.

Robinhood raised $ 1 billion from existing investors just hours after it halted purchases of GameStop, suggesting the free-trading app faced a potential cash shortage. https://t.co/AyG7v57RY3

— CNN (@CNN) January 29, 2021

Throughout all the restrictions placed on regular users, hedge funds were left unaffected, free to buy and sell as they wished.

Reddit and Twitter users were furious. How could a company that claims to democratize investing pull off such a stunt? And how could Reddit users be accused of market manipulation? After all, it was the institutional sellers who artificially depressed the price in the first place, and it was Robinhood and the SEC who were now manipulating the markets by restricting certain parts of it to certain people.

To anyone paying attention, perhaps it wasn’t such a surprise. Remember, it is free to trade on Robinhood—you are the product. Robinhood’s clients are big Wall Street trading firms. They pay Robinhood millions of dollars for their live trading data. It is one of the many reasons why you shouldn’t use Robinhood to invest.

Was this all a big conspiracy to give the hedge funds the time they need to readjust their portfolios and make sure they were financially safe? Once again, it appeared like Wall Street might be about to screw over the little guy.

But then something remarkable started to happen. Some of the biggest names in the financial and political worlds started to line up behind the users of WallStreetBets, attacking Robinhood for their stance.

People such as Ted Cruz, Alexandria Ocasio-Cortez, Elon Musk, Donald Trump Jr, Mark Cuban, the Winklevoss twins, and numerous CEOs from Wall Street itself all agreed. Robinhood was in the wrong; Reddit users were the good guys.

Fully agree. 👇 https://t.co/rW38zfLYGh

— Ted Cruz (@tedcruz) January 28, 2021

Robinhood et al. backed down and removed the trading restrictions on Thursday afternoon. Not long after, Discord lifted its ban.

By now, regular traders and investors were also starting to pay serious attention. Many people who normally wouldn’t consider opening such speculative positions started to buy GameStop stock to stand in solidarity with WallStreetBets and what they were trying to achieve. The cat was out of the bag, and the price started to recover.

This is the place in which we now find ourselves.

So, Is It All Over Now?

Not by a long shot.

Friday (January 29) is set to be a crucial day. The short percentage is still well above 120 percent, and it is the last trading day of the month, a day when many options contracts will expire, and owners will be forced to settle debts.

WallStreetBets is calling for a valuation of $ 1000/share. If they can maintain the same resolve not to sell that they have so far, an even larger bloodbath next week is not out of the question.

Should You Buy GameStop Today?

Hedge firms know they are in trouble. Wall Street has spent the entire week trying every trick in the book to try and crash the price. We’ve seen disinformation campaigns, bots flooding social media, trading restrictions, and coordinated attacks in the financial media. So far, it has made little difference.

But remember—GameStop might have been undervalued by Wall Street originally, but its stock price is now highly overvalued. It is not an “investment” in any meaningful sense of the word. Eventually, it will crash.

When that crash will happen, along with what price we might see before the crash happens, is anyone’s guess.

If you are thinking about buying GameStop to be part of this historic movement, keep in mind that it is pure speculation. The entire setup will only work if everyone holds their positions; if too many people start to sell, it might all unravel in record time. Yes, there is a chance that you make an extremely healthy profit, but there is also a chance that you’ll lose everything.

Just make sure you follow the golden rule: never invest more money than you can afford to lose.

What About the User Who Started it All?

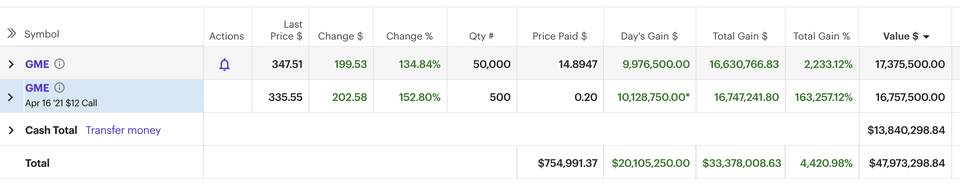

And finally, what became of the WallStreetBets user who made that first $ 50,000 investment in late-2019?

Well, he posts an update every day in the subreddit. As of yesterday, the initial investment was worth $ 47 million. Take that, Wall Street.